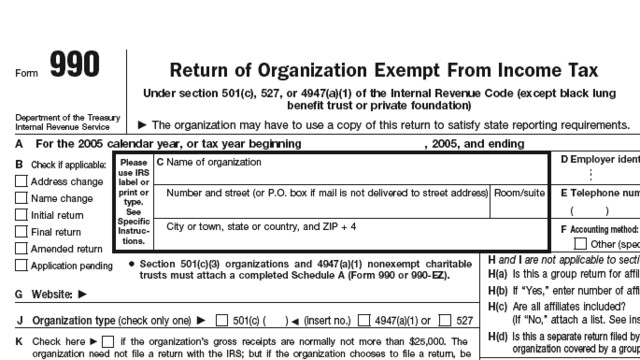

The American Institute of CPAs has provided comments on Form 990, Return of Organization Exempt from Income Tax, Form 990-T, Exempt Organization Business Income Tax Return, and related instructions.

Form 990 provides the public with financial information about a nonprofit organization, while Form 990-T is a form that a tax-exempt organization files with the IRS to report its unrelated business income and to figure the tax owed on that income. The letter was submitted in a matrix format and indicates the priority level of each recommendation.

Comments detailed in the Form 990 and 990-T matrices emphasize items that need clarification and additional questions that have arisen each year, such as new guidance issued that impacts the Form 990 and 990-T. This AICPA matrix provides the government with a helpful line-by-line analysis similar to a tax return.

The AICPA letter details more than 30 recommendations for both the Form 990 and Form 990-T. The recommendations related to Form 990-T are designed to help be able to handle the guidance and proposed regulations under section 512(a)(6) and other TCJA provisions, especially as the IRS moves the form to a platform that can accommodate mandatory e-filing.

Among the highest-priority recommendations included in the matrix are:

Form 990

- Consider updating the trigger questions for the foreign filings and the instructions to provide additional clarification when foreign filings are required for exempt organizations.

- Consider eliminating Schedule R, Part IV, Line 2. At a minimum, remove the requirement to disclose the amount of the transactions and report instead only the name of the related organization and the type of transaction.

Form 990-T

- Add worksheet to the Form 990‐T filing instructions to help tax preparers properly execute the provisions under proposed regulations regarding Unrelated Business Taxable Income Separately Computed for Each Trade or Business (REG-106864-18)

- Clarify in the instructions when Forms 965, 8991 and 8993 must be attached to Form 990‐T and if they should only reflect amounts subject to unrelated business income.

- Clarify the treatment of loss allocations within the instructions.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs